UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [ x ]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[X] ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ]X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Rule Section 240.14a-12

Arrow Financial Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[ xX ] No fee required

[ ] Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of the transaction:

5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

ARROW FINANCIAL CORPORATION

250 Glen Street

Glens Falls, New York 12801

March 29, 201927, 2020

Dear Shareholder:

You are cordially invited to attend the Arrow Financial Corporation Annual Meeting of Shareholders on

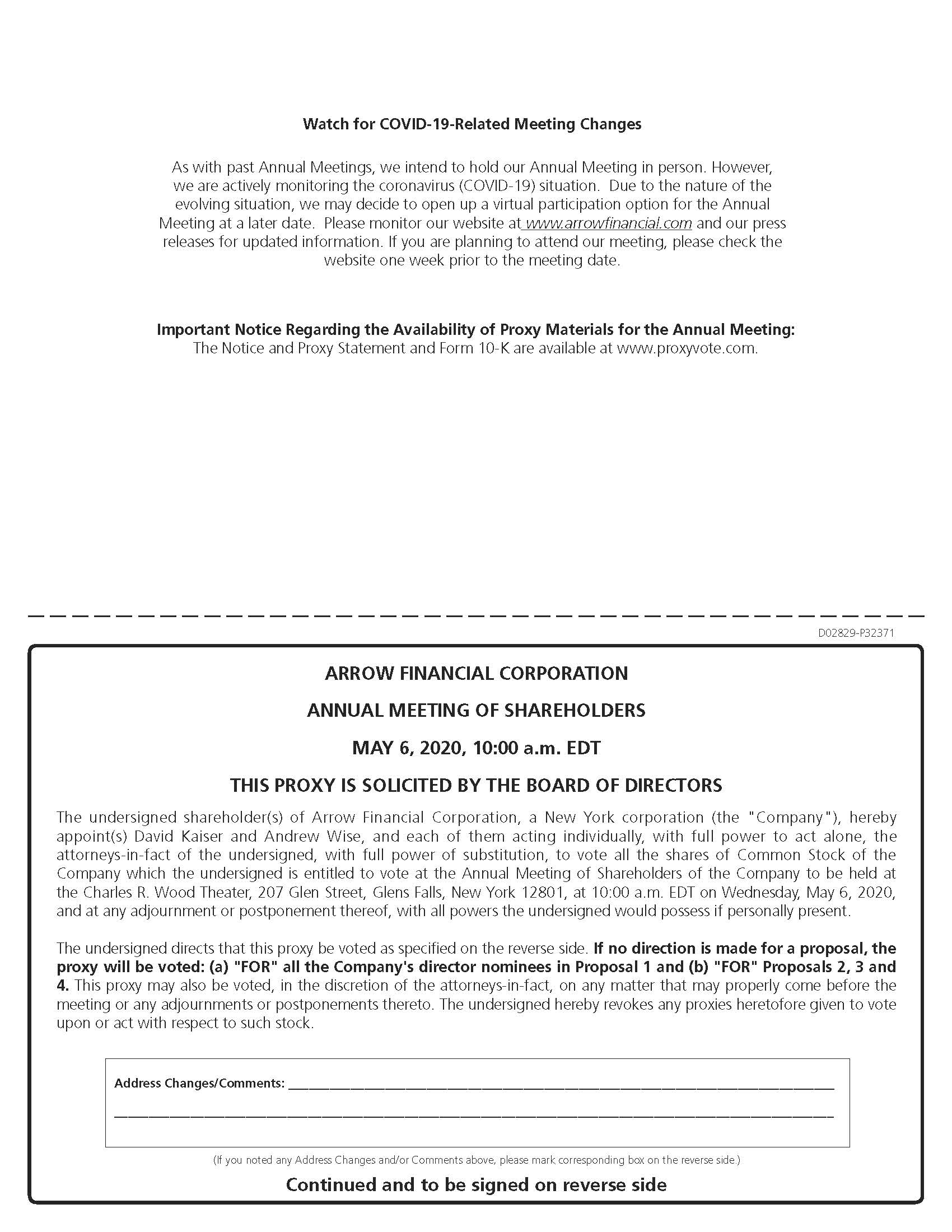

Wednesday, May 8, 2019,6, 2020, at 910 a.m. at the Charles R. Wood Theater in downtown Glens Falls, New York. As with past Annual Meetings, we intend to hold our Annual Meeting in person. However, we are actively monitoring the coronavirus (COVID-19) situation. We are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. Due to the nature of the evolving situation, we may decide to open up a virtual participation option for the Annual Meeting at a later date. Please monitor our website at www.ArrowFinancial.com and our press releases for updated information. If you are planning to attend our meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares promptly and in advance of the Annual Meeting.

The meeting will begin with a review of all voting matters and feature a short presentation on the Company. Additional details about the meeting and voting instructions can be found in the Notice of 20192020 Annual Meeting of Shareholders and related Proxy Statement.

We are proud of the financial performance and remarkable achievements of Arrow Financial Corporation and its familyFamily of companiesCompanies over the last year. Our team continuesThe Arrow team’s dedication is the driving force behind our accomplishments, and I want to demonstrate an unendingthank our employees for everything they do. Their commitment to improving our customer experience, serving our customerscommunities, and communities. Through their hard work,delivering value for the Company has continued its steady growth.organization keeps us competitive and strong.

Like most companies, ours facesfinancial institutions, we navigated a challenging interest rate environment and other economic conditions beyondpressures in 2019. Yet I am proud to share that we once again delivered record earnings, steady growth, sustained profitability, and excellent credit quality. We remain committed to living our control.mission for our customers, employees, shareholders and the communities we serve. Our measured and thoughtful approach to navigating through this is to staykeeps us focused on long-term opportunities that will help us continue to drive our business forward. Through strategic planning, spending and investments, we will remain a strong company that is well-positioned to deliver for our shareholders. We appreciate your support and we are grateful for your investmentgrow in Arrow Financial Corporation.the future.

For a better understanding of our Company, including its compensation practices and corporate governance structure, please review our proxy materials, most recent Annual Report on Form 10-K and our other securities filings. We hope you will vote, whether or not you plan to attend the Annual Meeting. It is important to us that your shares are represented.

Sincerely,

/s/ Thomas L. Hoy /s/ Thomas J. Murphy

Thomas L. Hoy Thomas J. Murphy

Chairman of the Board President and Chief Executive Officer

ARROW FINANCIAL CORPORATION

250 Glen Street

Glens Falls, New York 12801

NOTICE OF

20192020 ANNUAL MEETING OF SHAREHOLDERS

March 29, 201927, 2020

To the Shareholders of Arrow Financial Corporation:

The Annual Meeting of Shareholders of Arrow Financial Corporation, a New York corporation, will be held at the Charles R. Wood Theater, located at 207 Glen Street in Glens Falls, New York 12801, on Wednesday, May 8, 2019,6, 2020, beginning at 910 a.m. local time,time. As with past Annual Meetings, we intend to hold our Annual Meeting in person. However, we are actively monitoring the coronavirus (COVID-19) situation. We are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. Due to the nature of the evolving situation, we may decide to open up a virtual participation option for the Annual Meeting at a later date. Please monitor our website at www.ArrowFinancial.com and our press releases for updated information. If you are planning to attend our meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares promptly and in advance of the Annual Meeting.

The Annual Meeting of Shareholders of Arrow Financial Corporation will consider and vote upon the following matters, as described more fully in the Proxy Statement attached to this Notice:

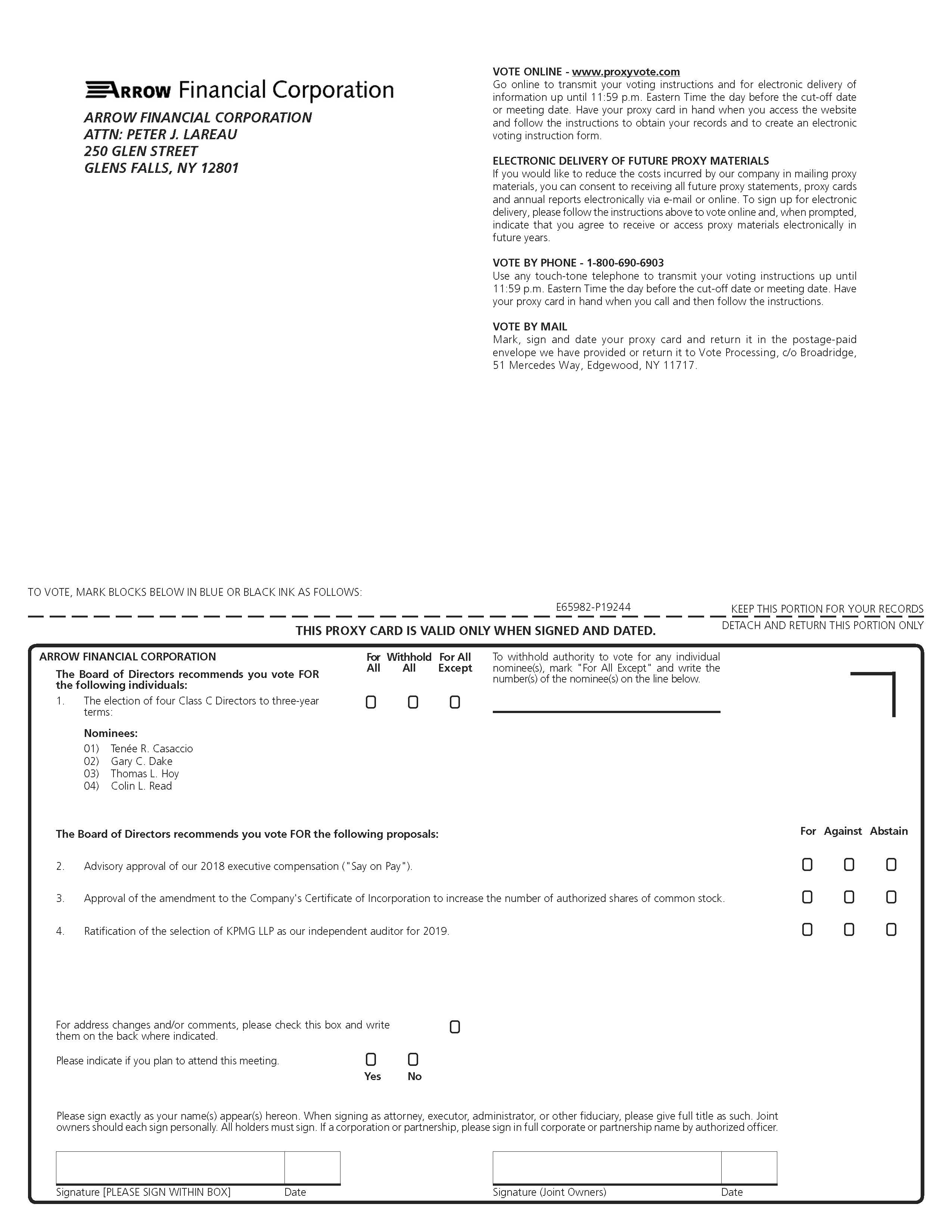

| |

| 1. | The election of four Class CA Directors to three-year terms. |

| |

| 2. | Advisory approval of our 20182019 executive compensation (“Say on Pay”). |

| |

| 3. | Approval of the amendmentArrow Financial Corporation 2020 Directors' Stock Plan to succeed and replace the Company's Certificate of Incorporation to increase the number of authorized shares of common stock.existing similar plan. |

| |

| 4. | Ratification of the selection of KPMG LLP as our independent auditor for 20192020. |

| |

| 5. | Any other business that may properly come before the 20192020 Annual Meeting, or any adjournment or postponement thereof. |

Shareholders of record as of the close of business on March 14, 2019,12, 2020 will be entitled to vote at the 20192020 Annual Meeting, or any adjournment or postponement thereof. Please see the Additional Voting Information section of the Proxy Statement for more information on how to vote.

Please ensure that your shares are represented at the 20192020 Annual Meeting, as your vote is important. If you plan to attend, we ask that you also complete the attendance section on your proxy card. See the attached Proxy Statement for more information on how to vote your shares. Thank you.

By Order of the Board of Directors,

/s/ Peter J. Lareau

Peter J. Lareau

Corporate Secretary

ARROW FINANCIAL CORPORATION

250 Glen Street

Glens Falls, New York 12801

PROXY STATEMENT TABLE OF CONTENTS

ARROW FINANCIAL CORPORATION

250 Glen Street

Glens Falls, New York 12801

PROXY STATEMENT

General Voting Information

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (“Board”) of Arrow Financial Corporation (“Company”), a New York corporation, of proxies to be voted at the 20192020 Annual Meeting of Shareholders (“Annual Meeting”) to be held Wednesday, May 8, 2019,6, 2020, at 910 a.m., at the Charles R. Wood Theater, 207 Glen Street, Glens Falls, New York 12801, or at any adjournment or postponement thereof.

The release of the Notice Regarding the Availability of Proxy Materials, the Notice of 20192020 Annual Meeting of Shareholders, the Proxy Statement and the Company's Annual Report on Form 10-K for the year ended December 31, 20182019 (collectively, the “Proxy Materials”) is scheduled to begin on March 29, 2019,27, 2020, to shareholders of record as of close of business on March 14, 2019.12, 2020. As of the record date, there were { _ }14,980,523 shares of Company common stock outstanding, and each share is entitled to one vote at the Annual Meeting.

To vote, please follow the instructions in the Notice Regarding the Availability of Proxy Materials or the other Proxy Materials. If you wish to receive a printed copy of the Proxy Materials, please follow the instructions in the Notice Regarding the Availability of Proxy Materials. The Proxy Materials will be mailed within three business days of receipt of your request. Shareholders who previously requested electronic copies will receive them in that format.

Please be sure that your shares are represented at the Annual Meeting by completing and submitting your proxy by telephone, online or by requesting and returning a completed paper proxy card. Please see the Additional Voting Information section of this Proxy Statement for more information on how to vote.

Voting Item 1 – Election of Four Class CA Directors to Three-Year Terms

Summary and Board Recommendation:

The Board of Directors is divided into three classes (A, B and C), with one class to be elected at each Annual Meeting of Shareholders for a term of three years. There are four Class A Directors, four Class B Directors, and four Class C Directors.

Item 1 at the Annual Meeting is the election of four Class CA Directors to three-year terms expiring at the 20222023 Annual Meeting of Shareholders and/or until their successors are elected and qualified. The Board has nominated for election Tenée R. Casaccio, Gary C. Dake, ThomasMark L. HoyBehan, Elizabeth A. Miller, William L. Owens, Esq. and Colin L. Read.Richard J. Reisman, DMD.

All four nominees were unanimously recommended by the Governance Committee to the Board, have been determined to be qualified, and have consented to serve if elected.

There are no arrangements or understandings between any Director or Director nominee and any other persons pursuant to which he or she was selected as a Director or nominee. None of the Directors are party to any agreement or

arrangement that would require disclosure pursuant to Listing Rule 5250(b)(3) for NASDAQ®, where the Company’s

common stock is listed. This rule requires disclosure of agreements or arrangements between a Director and a third party related to the Director's service on the Board.

The Board has no reason to believe that any of these nominees will decline or be unable to serve if elected. Under applicable law and the Company’s Bylaws, Directors are elected by a plurality of the shares voted at the Annual Meeting, meaning the nominees receiving the most “For” votes will be elected. For additional information regarding the vote requirements for Item 1 and a description of the Company’s Majority Voting Policy with respect to the election of Directors, please see the Additional Voting Information section.

Vote Recommendation: Your Board recommends you vote “For” each of its four nominees:

Tenée R. Casaccio, Gary C. Dake, ThomasMark L. HoyBehan, Elizabeth A. Miller, William L. Owens, Esq. , and Colin L. Read.Richard J. Reisman, DMD.

Director Nomination Process:

The Governance Committee is responsible for identifying and recommending to the full Board suitable nominees to serve as Directors, including incumbents. Director nominees are selected based upon the following criteria:

Individual Strengths: The candidate’s knowledge, skill, experience and expertise

Board Composition: The objective of achieving certain characteristics for the Board as a group, such as diversity of background, occupation, viewpoint and gender

Succession Planning: Balance among age groups from those who are in mid-career to those nearing or recently entered into retirement

Additionally, the Governance Committee will not generally recommend a new candidate for nomination unless the candidate has demonstrated notable leadership and accomplishment in business, higher education, politics and/or cultural endeavors. The Governance Committee further assesses a candidate’s understanding of the regulatory and policy environment in which the Company does business and his or her interest in the communities served by the Company. Other factors considered by the Governance Committee include a candidate’s personal character, integrity and financial acumen. For candidates with prior experience as a Director of the Company or one of its subsidiaries, his or her service record will be an important factor in evaluating the desirability of his or her continuing service as a Director. Generally, Directors may not serve on the boards of more than two other public companies and may not serve on the board of any other public company whose principal business is financial services.

To identify new candidates for Director, the Governance Committee will employ its own search protocols, seek suggestions from Management and consider any Director nominee proposals it properly receives from shareholders. The same screening process is applied to all suggested candidates, regardless of the source. The Board will give substantial weight to the recommendations of the Governance Committee in selecting Director nominees for election and in filling Director vacancies. Under normal circumstances, the Board will not select nominees, including incumbent Directors, who have not been recommended by a majority of the members of the Governance Committee. For information on how shareholders may participate in the Director nomination process, see “Shareholder Submissions of Director Nominees for the 20202021 Annual Meeting” in the Additional Shareholder Information section.

Nominee and Continuing Director Biographies:

We have prepared the following biographies to provide shareholders with detailed information about each Director, including his or her areas of strength. No specific minimum qualification standards have been established.

tClass CA Nominees (terms expiring in 2022,2023, if elected)

Mark L. Behan, age 59, became a Director of the Company on January 1, 2017; he has been a Director of the Company's lead subsidiary bank, Glens Falls National Bank and Trust Company ("GFNB"), since 2015. Mr. Behan is the President of Behan Communications, Inc., a public affairs and strategic communications firm serving national and regional clients and is an adviser to chief executives in major businesses and nonprofit organizations in the Capital Region of New York State, which he founded in 1988. He has a bachelor's degree from Colgate University. Mr. Behan brings public affairs, public relations, communications and government relations expertise to the Board.

Elizabeth A. Miller, age 66, became a Director of the Company on January 1, 2017; she has been a Director of GFNB since 2015. Ms. Miller has been President and Chief Executive Officer ("CEO") of Miller Mechanical Services, Inc., in Glens Falls since 2007 and Chair of Doty Machine Works in Fort Edward since 2014. She holds bachelor’s and master’s degrees from the College of Saint Rose. Ms. Miller has a strong understanding of the community and its business base, particularly local manufacturing.

William L. Owens, Esq., age 71, has been a Director of the Company and GFNB since 2015. Mr. Owens is a former U.S. Congressman who represented New York’s 21st District from 2009 to 2015. Prior to his election to Congress, he was a managing partner at Stafford, Owens, Piller, Murnane, Kelleher & Trombley, PLLC, a Plattsburgh, New York law firm, where he practiced business and tax law for more than 30 years. In 2015, he rejoined the firm as a partner and resumed his role as Managing Partner in 2016. He also serves as Senior Advisor for Dentons (formerly McKenna Long & Aldridge, LLP), an international law firm. Mr. Owens holds a bachelor’s degree from Manhattan College and a law degree from Fordham University. He has a unique understanding of the North Country, specifically the Plattsburgh market, and is a leading authority on U.S.-Canada trade issues.

Richard J. Reisman, DMD, age 74, has been a Director of both the Company and GFNB since 1999.

Dr. Reisman is an oral and maxillofacial surgeon and serves as Chair of the Section of Dentistry at Glens Falls Hospital, a regional medical center. Dr. Reisman received a bachelor’s degree from the University of Massachusetts-Amherst and a DMD from Harvard University. He also completed an oral surgery residency at Mt. Sinai Hospital in New York City. Dr. Reisman is a member of the New York State Board for Dentistry. His prior oral surgery practice in the Glens Falls community and his service at Glens Falls Hospital provide him with both small business acumen and large business organizational experience and expertise.

Continuing Class B Directors (terms expiring in 2021)

Michael B. Clarke, age 73, has been a Director of the Company and GFNB since 2006. He previously served as a Director of the Company and GFNB from the late 1980s until 1999, before temporarily relocating out of the area. Mr. Clarke has experience in the cement manufacturing industry. He served as President of Glens Falls Cement Company from 1985 to 1999, President and CEO of Lone Star Industries in Indiana from 1999 to 2004, and President of the Midwest Division of Buzzi Unicem, USA, from 2004 to 2005. Mr. Clarke has a bachelor’s degree from McGill University and an MBA from Harvard University. In addition to his executive experience at manufacturing companies, Mr. Clarke has a finance background and a longstanding historical knowledge of the Company.

David G. Kruczlnicki, age 67, has been a Director of the Company since 1989 and a Director of the Company's subsidiary bank, Saratoga National Bank and Trust Company ("SNB"), since 2015. He previously served 26 years as a Director of GFNB. Mr. Kruczlnicki is President of a consulting firm that advises nonprofits on business planning, and he teaches at Siena College and Clarkson University Graduate School and UNC/Chappel Hill. He was President and CEO of Glens Falls Hospital, a large regional medical center, from 1989 until his retirement in 2013. Mr. Kruczlnicki received a bachelor’s degree from Siena College and a master’s degree from Rensselaer Polytechnic Institute. As a former health care executive, Mr. Kruczlnicki has significant experience overseeing finance and human resources as well as directorship experience with numerous private and regional organizations.

Thomas J. Murphy, age 61, has been a Director of the Company since 2012 and a Director of GFNB since 2011. He has been CEO of the Company and GFNB since 2013. In 2012, he became President of the Company, following his appointment as President of GFNB in 2011, and continues to serve in those positions. Mr. Murphy joined GFNB in 2004 as Manager of the Personal Trust Department after 16 years as a founding partner in CMJ, LLP, a Glens Falls certified public accounting firm. He served in a variety of banking, trust and corporate capacities prior to leading the Company and GFNB. Mr. Murphy holds a bachelor’s degree in Business Administration from Siena College. He held a CPA license for over 30 years and combines his expert knowledge of accounting with more than 10 years of experience in various management positions with the Company and its subsidiaries to provide valuable leadership and expertise.

Raymond F. O’Conor, age 64, became a Director of the Company on January 1, 2017; he has been a Director of SNB since 1996 and Chairman of the SNB Board of Directors since 2001. He was a Senior Vice President of the Company from 2009 until his retirement in 2012 and also served as President and CEO of SNB from 1995 until his retirement at the end of 2012. Mr. O’Conor is also a published author and CEO of Saratoga County Capital Resource Corporation, a community development agency. He has an extensive knowledge of community banking, and more specifically, the Company, as a former member of the executive management team.

Continuing Class C Directors (terms expiring in 2022)

Tenée R. Casaccio, AIA, age 53,54, has been a Director of the Company since December 2013 and the lead subsidiary bank Glens Falls National Bank and Trust Company ("GFNB")GFNB since 2010. Ms. Casaccio has served as President of JMZ Architects and Planners, PC, a New York State-certified Women-Ownednationally-certified Women Owned Business Enterprise located in Glens Falls, since 2009. She earned a Bachelor of Architecture from Virginia Tech and holds licenses to practice architecture in New York and several other states. Ms. Casaccio has been with JMZ Architects since 1993. She has significant executive experience and a strong understanding of the New York State business climate.

Gary C. Dake, age 58,59, has been a Director of the Company since 2003 and a Director of the Company’s subsidiary bank, Saratoga National Bank and Trust Company (“SNB”)SNB since 2001.

Mr. Dake is President of Stewart’s Shops Corp., a large, privately owned, vertically integrated, multi-state convenience store chain, and of Stewart’s Processing Corp., an affiliated dairy manufacturing and processing company. Mr. Dake holds a bachelor’s degree from St. Lawrence University. He has experience with large business operations as a result of his management of Stewart’s, which also gives him a unique and broad understanding of the many communities the Company serves.

Thomas L. Hoy, age 70,71, has been a Director of the Company since 1996, Chairman of the Board since 2004, a Director of GFNB since 1994, and Chairman of the Board of GFNB since 2004. He was President of the Company from 1996 to 2012, and CEO from 1997 until his retirement at the end of 2012. In addition, Mr. Hoy was President of GFNB from 1995 to 2011. Mr. Hoy’s more than four-decade career with our organization started in 1974 as a management trainee and included various roles in GFNB’s Trust and Investment Division. He serves on the Federal Home Loan Bank of New York Board of Directors, a role he has held since 2011. Mr. Hoy holds a bachelor’s degree from Cornell University. His expertise in the banking, investment and financial services industries – both generally and as our former President and CEO of the Company – is of great value to the Company.

Colin L. Read, PhD, age 59,60, has been a Director of the Company since 2013 and a Director of GFNB since 2010. Dr. Read teaches banking and finance as a tenured full professor in the State University of New York system. He was elected Mayor of Plattsburgh, NY in 2016, after three years of service on the Clinton County Legislature. He is a published author, with various contributions to print, online and television media, as well as 12 books on global finance. Dr. Read has a PhD in economics from Queen’s University, an MBA from the University of Alaska, a law degree from the University of Connecticut, and a master’s degree in Taxation from the University of Tulsa. His expertise in economics and understanding of the Plattsburgh area are key strengths.

tContinuing Class B Directors (terms expiring in 2021)

Michael B. Clarke, age 72, has been a Director of the Company and GFNB since 2006. He previously served as a Director of the Company and GFNB from the late 1980s until 1999, before temporarily relocating out of the area. Mr. Clarke has experience in the cement manufacturing industry. He served as President of Glens Falls Cement Company from 1985 to 1999, President and CEO of Lone Star Industries in Indiana from 1999 to 2004, and President of the Midwest Division of Buzzi Unicem, USA, from 2004 to 2005. Mr. Clarke has a bachelor’s degree from McGill University and an MBA from Harvard University. In addition to his executive experience at manufacturing companies, Mr. Clarke has a finance background and a longstanding historical knowledge of the Company.

David G. Kruczlnicki, age 66, has been a Director of the Company since 1989 and a Director of SNB since 2015. He previously served 26 years as a Director of GFNB. Mr. Kruczlnicki is President of a consulting firm that advises nonprofits on business planning, and he teaches at Siena College and Clarkson University Graduate School. He was President and CEO of Glens Falls Hospital, a large regional medical center, from 1989 until his retirement in 2013. Mr. Kruczlnicki received a bachelor’s degree from Siena College and a master’s degree from Rensselaer Polytechnic Institute. He also served on the boards of directors of several affiliates of Glens Falls Hospital, numerous other health-related organizations, and Pruyn & Company, a local, privately owned paper company. As a former health care executive, Mr. Kruczlnicki has significant experience overseeing finance and human resources as well as directorship experience with numerous private and regional organizations.

Thomas J. Murphy, age 60, has been a Director of the Company since 2012 and a Director of GFNB since 2011. He has been CEO of the Company and GFNB since 2013. In 2012, he became President of the Company, following his appointment as President of GFNB in 2011, and continues to serve in those positions. Mr. Murphy joined GFNB in 2004 as Manager of the Personal Trust Department after 16 years as a founding partner in CMJ, LLP, a Glens Falls certified public accounting firm. He served in a variety of banking, trust and corporate capacities prior to leading the Company and GFNB. Mr. Murphy holds a bachelor’s degree in Business Administration from Siena College. He held a CPA license for over 30 years and combines his expert knowledge of accounting with more than 10 years of experience in various management positions with the Company and its subsidiaries to provide valuable leadership and expertise.

Raymond F. O’Conor, age 63, became a Director of the Company on January 1, 2017; he has been a Director of SNB since 1996 and Chairman of the SNB Board of Directors since 2001. He was a Senior Vice President of the Company from 2009 until his retirement in 2012 and also served as President and CEO of SNB from 1995 until his retirement at the end of 2012. Mr. O’Conor is a published author and CEO of Saratoga County Capital Resource Corporation, a community development agency. He has an extensive knowledge of community banking, and more specifically, the Company, as a former member of the executive management team.

tContinuing Class A Directors (terms expiring in 2020)

Mark L. Behan, age 58, became a Director of the Company on January 1, 2017; he has been a Director of GFNB since 2015. Mr. Behan is the President of Behan Communications, Inc., a public affairs and strategic communications firm with offices in Albany and Glens Falls, which was founded by him in 1988. He has a bachelor's degree from Colgate University. Mr. Behan brings public affairs, public relations, communications and government relations expertise to the Board.

Elizabeth A. Miller, age 65, became a Director of the Company on January 1, 2017; she has been a Director of GFNB since 2015. Ms. Miller has been President and CEO of Miller Mechanical Services, Inc., in Glens Falls since 2007 and Chair of Doty Machine Works in Fort Edward since 2014. She holds bachelor’s and master’s degrees from the College of Saint Rose. Ms. Miller has a strong understanding of the community and its business base, particularly local manufacturing.

William L. Owens, Esq., age 70, has been a Director of the Company and GFNB since 2015. Mr. Owens is a former U.S. Congressman who represented New York’s 21st District from 2009 to 2015. Prior to his election to Congress, he was a managing partner at Stafford, Owens, Piller, Murnane, Kelleher & Trombley, PLLC, a Plattsburgh, New York law firm, where he practiced business and tax law for more than 30 years. In 2015, he rejoined the firm as a partner and resumed his role as Managing Partner in 2016. He also serves as Senior Advisor for Dentons (formerly McKenna Long & Aldridge, LLP), an international law firm. Mr. Owens holds a bachelor’s degree from Manhattan College and a law degree from Fordham University. He has a unique understanding of the North Country, specifically the Plattsburgh market, and is a leading authority on U.S.-Canada trade issues.

Richard J. Reisman, DMD, age 73, has been a Director of both the Company and GFNB since 1999.

Dr. Reisman is an oral and maxillofacial surgeon and serves as Chair of the Section of Dentistry at Glens Falls Hospital, a regional medical center. Dr. Reisman received a bachelor’s degree from the University of Massachusetts-Amherst and a DMD from Harvard University. He also completed an oral surgery residency at Mt. Sinai Hospital in New York City. Dr. Reisman is a member of the New York State Board for Dentistry. His oral surgery practice in the Glens Falls community and his service at Glens Falls Hospital provide him with both small business acumen and large business organizational experience and expertise.

Director Compensation:

The Compensation Committee makes recommendations to the full Board regarding Director compensation. The Board itself, however, is responsible for determining the compensation payable to Directors for their services. Amounts paid for service on subsidiary bank boards are considered by the Board in its periodic review of total Director compensation.

tCompensation Components

There are three basic components of the compensation paid to Company Directors: basic annual retainer, meeting fees and incentive stock-based compensation. Only non-Management Directors receive compensation for their services as Directors. Management Directors (those persons who are also officers) receive no additional compensation for their services as Directors. Thus, Mr. Murphy, who is both a Director and an Executive Officer of

the Company, received no Director compensation in 2018,2019, although he was entitled to reimbursement of any expenses he incurred in connection with his service as a Director.

Basic Annual Retainer and Meeting Fees

Each non-Management Director of the Company receives a fixed basic annual retainer fee for serving as a

Company Director as well as a fixed basic annual retainer fee for serving as a Director of one of the Company's subsidiary banks. Non-Management Directors also receive fees for attending meetings of the Company’s Board (and its committees) and meetings of a subsidiary bank’s board (and its committees). Moreover, if a non-Management Director serves as a Chair of the Company's Board (or one of its committees) or as Chair of one of the subsidiary banks' boards (or one of its committees), he or she will also receive a supplemental annual retainer fee commensurate with the increased responsibility accompanying such position. Directors who serve on a Company or subsidiary bank committee but do not serve as the Chair thereof do not receive a supplemental annual retainer fee.

A Director’s total annual retainer fee, including any supplemental annual retainer fee for service as a Board or committee chair, is currently paid semi-annually (May and November) in advance of the period to which such payment relates. Directors who are appointed or elected to the Board in the middle of one of these six-month periods receive a pro rata share of the annual retainer fee receivable by those Directors who serve for the entire period. This fee is paid to new Directors at or about the time their service commences.

Under the Arrow Financial Corporation 2013 Directors’ Stock Plan (“2013 Directors’ Stock Plan”), the Board may elect from time to time to pay some or all of the Directors’ fees, including annual retainer and meeting fees, in the form of shares of Company common stock as opposed to cash. Distributions of shares in lieu of cash are made twice annually. The number of shares actually distributable to Directors is calculated based on the market price of the Company’s common stock on the date of distribution. All shares distributed under the 2013 Directors’ Stock Plan in lieu of cash are fully vested and transferable by the recipient Directors on the date of distribution, subject to applicable securities laws and our stock ownership and other guidelines. In 2018,2019, as in prior years, the Board decided to pay a portion of the basic annual retainer fee payable to each non-Management Director for such year in the form of shares of stock under the 2013 Directors’ Stock Plan.

The following table sets forth the dollar value of Directors’ fees paid in cash and/or shares of the Company’s common stock to non-Management Directors in 20182019 for their service on the Company’s Board, any subsidiary bank board, and committees thereof. The table shows the basic annual retainer fees, any supplemental annual retainer fees for serving as a Board or committee Chair, and fees for Board and committee meetings attended. All changes were approved by the Board at its meeting in January 2018.2019.

| | BASIC ANNUAL RETAINER FEES | | 2018 | Company | GFNB | SNB | |

| 2019 | | Company | GFNB | SNB |

Basic Annual Retainer (a) | $21,000 | $13,500 | $11,500 | $ | 22,000 |

| $ | 16,000 |

| $ | 14,000 |

|

| Chair of Board | $9,000 | 9,000 |

| 9,000 |

| 9,000 |

|

| Chair of Audit Committee | $7,500 | N/A | 7,500 |

| N/A |

| N/A |

|

| Chair of Compensation Committee | $5,000 | N/A | 5,000 |

| N/A |

| N/A |

|

| Chair of Governance Committee | $5,000 | N/A | 5,000 |

| N/A |

| N/A |

|

| Chair of Wealth Management Committee | N/A | $5,000 | N/A | N/A |

| 5,000 |

| N/A |

|

MEETING FEES | Board of Directors (b) | $700 | $500 | 700 |

| 500 |

| 500 |

|

Committee of the Board (b) | $550 | $400 | 550 |

| 400 |

| 400 |

|

| |

| (a) | In 2018, $10,0002019, $11,000 of the basic annual retainer fee for service as a Director of the Company and $5,500$8,000 of the basic annual retainer fee for service as a Director of GFNB orand $7,000 of the basic annual retainer fee for service as a Director of SNB were paid in shares of the Company’s common stock. |

With respect to 20192020 Director compensation, at its January 20192020 meeting, the Board increased the basic annual retainer by $1,000 to a total of $22,000 for the Company and by $2,500 for each of the subsidiary banks to a total of $16,000 and $14,000, respectively, for GFNB and SNB. All otherdetermined that all Director fees would remain the same for the Board and the Company’s subsidiary banks.

Under the Company’s Directors’ Deferred Compensation Plan, Directors of the Company and its subsidiary banks may elect to defer receipt of some or all of the cash fees otherwise payable to them in any year to a later date, subject to certain limits set forth in such plan and applicable law. Under this unfunded plan, amounts deferred are credited to the plan account of the deferring Director. The deferred amounts earn interest from time to time at a rate equal to the highest rate being paid on individual retirement accounts by GFNB. Deferred

amounts are ultimately distributable on a date or dates selected by the Director, subject to certain restrictions. Distributions under the plan are payable in cash, either in a lump-sum or in annual installments as the participant may choose. During 2018,2019, no Directors elected to defer fees under the plan.plan.

Incentive Stock-Based Compensation

Under the Company’s current long-term incentive plan, the Arrow Financial Corporation 2013 Long Term Incentive Plan (“2013 LTIP”), the Board is authorized, in its discretion and after consultation with the Compensation Committee, to make grants of stock-based incentive awards to non-Management Directors of the Company as additional compensation for their service as Directors. The terms and conditions of awards granted to Directors are established by the Board itself, not by the Compensation Committee. The Board believes the grant of such awards, particularly in the form of stock options for the Company’s common stock, serves an important purpose by further aligning Directors’ interests with those of shareholders, as stock options only provide value to the holder if the Company’s stock price increases.

Historically, the Board has approved annual grants of a fixed number of stock options to non-Management Directors under the 2013 LTIP (and predecessor plans). Such options typically vest ratably over a four-year period, subject to accelerated vesting in the event of a change-in-control of the Company. All Directors’ stock options granted under the 2013 LTIP have a maximum term of 10 years from the date of the grant and are exercisable only while the Director continues to serve in such capacity and, for a short period following termination of service. The Board may elect to accelerate the vesting of options on a case-by-case basis, to extend the period of post-termination exercisability up to the maximum term of the option and has often elected to do so in practice. All options granted to Directors in 20182019 will vest ratably over a four-year period, reinforcing the long-term nature of the grant. The exercise price for all stock options granted to Directors in 20182019 was the fair market value of the Company’s common stock on the date of grant, i.e., the reported closing price of the stock on such date.

In early 2018,2019, the Board granted to each then currentthen-current non-Management Director who also was a Director in 2017,2018, a standard annual incentive award for a fixed maximum number of stock options under the 2013 LTIP, subject to downward adjustment in any particular case if the individual Director’s attendance record for meetings of the Company Board and committees during the prior year was less than 100%. Specifically, each eligible non-Management Director received a number of options equal to 1,000, multiplied by the Director’s “meeting attendance ratio” for the prior year, which consists of: (i) the number of meetings of the Company’s Board and its committees on which the Director serves held during the prior year that the Director actually attended, divided by (ii) the total number of such meetings held during the prior year. The number and grant date value of all such options are listed in the “20182019 Director Compensation Table” later in this section.

In early 2019,2020, the Board granted to each eligible non-Management Director for their 20182019 service a standard annual incentive award of stock options under the 2013 LTIP, generally subject to the usual terms and same maximum amount and downward adjustments, if any, as pertained to the 20182019 grants described above.

tStock Ownership Guidelines

In order to better align the interests of Directors with the interests of our shareholders, the Company has established individual stock ownership guidelines for non-Management Directors. Under these guidelines, each non-Management Director of the Company is expected to achieve, within five years following his or her election or appointment to the Board, and thereafter to maintain as long as he or she serves as a Director, beneficial ownership of a number of shares of the Company’s stock having a market value at least equal to five times the basic annual retainer fee payable from time to time to such Director for serving on the Company’s Board. Under normal circumstances, if and for so long as a non-Management Director does not meet this target level of beneficial ownership, restrictions may be placed on the Director’s ability to sell shares of the Company’s common stock obtained through the exercise of stock option awards previously or subsequently granted to the Director under the 2013 LTIP, predecessor plans or successor plans. The target ownership requirement for each non-Management

Director is measured by the Compensation Committee as of each year-end, using holdings valued as of December 31 of such year. Common shares owned outright (including shares held jointly with a spouse) or held through

Company plans (e.g., the Company’s Automatic Dividend Reinvestment Plan) are currently counted toward the stock ownership requirement. Unexercised stock options do not count toward the stock ownership requirement. The independent members of the Board have the discretion to address and approve exceptions.

The Compensation Committee has determined that, at December 31, 2018,2019, all non-Management Directors who have

served on the Company's Board for at least five years have met the stock ownership guidelines. Management Directors are subject to a separate policy; for a description, see “Stock Ownership Guidelines” in the Compensation Discussion and Analysis section.

t 20182019 Director Compensation Table

The following Director Compensation Table summarizes all compensation paid by the Company and its subsidiaries to the non-Management Directors of the Company for the fiscal year ended December 31, 2018.2019. Management Directors (who, in 2018,2019, consisted solely of Mr. Murphy) do not receive any compensation for service as Directors of the Company or either of its subsidiary banks. Compensation received in 20182019 by Mr. Murphy is reported in the “Summary Compensation Table” within the Executive Compensation section.

| | | Director | Fees Earned

or Paid

in Cash | Stock

Awards

(a) | Option Awards

(b) | Change in

Pension Value/ Nonqualified Deferred Compensation Earnings | All Other Compensation | 2018 Director Compen- sation

Total | Fees Earned

or Paid

in Cash | Stock

Awards

(a) | Option Awards

(b) | Change in

Pension Value/ Nonqualified Deferred Compensation Earnings | All Other Compensation | 2019 Director Compensation

Total |

| Mark L. Behan | $31,900 |

| $15,500 |

| $5,759 | | — | — | $53,159 | $ | 31,200 |

| $ | 19,000 |

| $ | 5,748 |

| $ | — |

| $ | — | | $ | 55,948 |

|

| Tenée R. Casaccio | $32,050 | | $15,500 | | $5,759 | | — | — | $53,309 | 31,200 |

| 19,000 |

| 5,748 |

| — |

| — | | 55,948 |

|

| Michael B. Clarke | $39,500 | | $15,500 | | $5,759 | | — | — | $60,759 | 39,850 |

| 19,000 |

| 5,748 |

| — |

| — | | 64,598 |

|

| Gary C. Dake | $34,950 | | $15,500 | | $5,759 | | — | — | $56,209 | 34,200 |

| 18,000 |

| 5,748 |

| — |

| — | | 57,948 |

|

| Thomas L. Hoy | $47,200 | | $15,500 | | $5,759 | | — | $36,000 | (c) | $104,459 | 46,500 |

| 19,000 |

| 5,748 |

| — |

| — | | 71,248 |

|

| David G. Kruczlnicki | $35,500 | | $15,500 | | $5,759 | | — | $2,888 | (d) | $59,647 | 36,350 |

| 18,000 |

| 5,748 |

| — |

| 2,925 |

| (c) | 63,023 |

|

| Elizabeth A. Miller | $32,500 |

| $15,500 |

| $5,759 | | — | — | $53,759 | 31,250 |

| 19,000 |

| 5,748 |

| — |

| — | | 55,998 |

|

| Raymond F. O'Conor | $37,800 |

| $15,500 |

| $5,759 | | — | — | $59,059 | 38,100 |

| 18,000 |

| 5,748 |

| — |

| — | | 61,848 |

|

| William L. Owens | $31,950 | | $15,500 | | $5,235 | | — | — | $52,685 | 30,700 |

| 19,000 |

| 5,748 |

| — |

| — | | 55,448 |

|

| Colin L. Read | $33,050 | | $15,500 | | $5,759 | | — | — | $54,309 | 32,350 |

| 19,000 |

| 5,748 |

| — |

| — | | 57,098 |

|

| Richard J. Reisman | $38,833 | | $15,500 | | $5,759 | | — | $5,361 | (d) | $65,453 | 37,850 |

| 19,000 |

| 5,748 |

| — |

| 5,431 |

| (c) | 68,029 |

|

| |

| (a) | Represents that portion of each listed Director’s total Directors’ fees that were payable in shares of Company stock, in accordance with the 2013 Directors’ Stock Plan. In 2018,2019, this amount consisted of $10,000$11,000 of eachthe Director’s basic annual retainer fee for serving as a Company Director and $5,500$8,000 of eachthe Director’s basic annual retainer fee for serving as a Director of oneGFNB or $7,000 of the Company’s subsidiary banks.Director's basic annual retainer fee for serving as a Director of SNB,. Additional payments represent fees related to service on committees. For purposes of determining the number of shares of the Company’s common stock distributable to these Directors, the shares are valued at the market price of the Company’s common stock on the date of distribution, in accordance with FASB ASC TOPIC 718. In 2018,2019, these Directors received, as payment of that portion of their basic annual retainer fee regularly payable in such year in shares of Company stock, two distributions of shares: the first on May 30, 2018,2019, at a per share price of $37.95,$32.49, and the second on November 29, 2018,2019, at a per share price of $35.13.$35.86. As of December 31, 2018,2019, each non-employee Director held the following aggregate number of shares: Behan 2,1542,855 shares, Casaccio 10,19811,774 shares, Clarke 13,95613,250 shares, Dake 42,98031,447 shares, Hoy 190,248199,616 shares, Kruczlnicki 37,55640,399 shares, Miller 23,62825,381 shares, O'Conor 44,38844,949 shares, Owens 5,6237,320 shares, Read 8,3088,809 shares and Reisman 13,40115,490 shares. |

| |

| (b) | Stock options granted to Directors are valued in accordance with FASB ASC TOPIC 718. The stock options were granted January 31, 2018,30, 2019, at a per share exercise price of $31.84,$30.79, the closing price of our common stock on the date of grant as restated for the 3% stock dividend distributed in September 2018.2019. Options vest ratably over a period of four years following the date of grant. As of December 31, 2018,2019, each non-employee Director held the following aggregate number of vested stock options: Behan 0265 options, Casaccio 1,6472,803 options, Clarke 2,2283,402 options, Dake 1,369811 options, Hoy 33,6973,912 options, Kruczlnicki 01,107 options, Miller 0265 options, O'Conor 0265 options, Owens 811787 options, Read 2,7833,973 options and Reisman 7,5307,570 options. |

| |

| (c) | Represents consulting fees earned and paid to Mr. Hoy under his consulting agreement. See “Mr. Hoy’s Consulting Agreement.”

|

| |

(d) | Represents interest earned by the listed Director during 20182019 on the principal balance of the Director’s account under the Directors’ Deferred Compensation Plan. |

tMr. Hoy's Consulting Agreement

Mr. Hoy, a Director of the Company and Chairman of the Board, served for many years as the Company's President and CEO prior to his retirement at the end of 2012. At that time, the Company entered into a three-year consulting agreement with Mr. Hoy, which was renewed for another three-year term on January 1, 2016. The agreement expired by its terms on December 31, 2018. Under the agreement, Mr. Hoy rendered advice and assistance regarding management and operation of the Company, as requested by the CEO or Board. In return, he received $36,000 annually, payable in equal monthly installments. He also received office space, administrative support and equipment as agreed by the parties for the provision of the consulting services. The agreement contains confidentiality and non-competition provisions in favor of the Company. Mr. Hoy has not received any additional stock options from the Company in connection with his post-retirement service to the Company as a consultant. However, all outstanding stock options granted to Mr. Hoy under the Company’s long-term incentive plans before his retirement as CEO continued to vest, to the extent unvested at his retirement, during his post-retirement consultancy. In October 2018, the Compensation Committee extended the exercise period of all vested and unexercised options held by Mr. Hoy to allow for exercise over the maximum 10-year term of such options. The stock options granted to Mr. Hoy under the long-term incentive plan as a non-Management Director (following his retirement as CEO) are not subject to or affected by his continuing service as a consultant to the Company.

Voting Item 2 – Advisory Approval of Our 20182019 Executive Compensation ("Say on Pay")

Summary and Board Recommendation:

Item 2 is a proposal to approve on an advisory basis the Company’s 20182019 executive compensation (“Say on Pay”), as described in the Compensation Discussion and Analysis section. This vote is not intended to address a specific item of compensation, but rather the overall compensation of the Named Executive Officers (“NEOs”) and the philosophies, policies and practices as described in this Proxy Statement. Say on Pay is an advisory proposal, so the Company is not required to take any action as a result of this vote. However, the Compensation Committee will be asked to review the results of the shareholder vote to determine if any additional action is required, and it will carefully consider the results as part of its regular review and recommendations regarding executive compensation.

The most recent Say on Pay advisory vote taken at the 20182019 Annual Meeting of Shareholders was approved by shareholders. Approval of Say on Pay will require the affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting and voting on this proposal.

Vote Recommendation: Your Board recommends you vote “For,” on an advisory basis, the Company’s executive compensation, or Say on Pay.

Say on Pay Details:

The Company believes its executive compensation program is well-designed, appropriately aligns executive pay with Company performance, and attracts, motivates and retains individuals whose interests are aligned with shareholders. Please see the "Compensation Discussion and Analysis" section for more information on compensation decisions and practices. As noted in the "Compensation Discussion and Analysis" section, the Company takes a conservative and consistent approach to its executive compensation program. We believe the program ties executive compensation in an appropriate way to corporate and individual performance in order to drive Company growth and shareholder value. We also believe the compensation programs, in total, use responsible and reasonable methods to motivate, retain and reward the NEOs. This approach helps the Company promote long-term profitability within acceptable risk parameters. The Company's key practices are highlighted below:

Say on Pay: Following the frequency of say on pay advisory shareholder vote at the 20182019 Annual Meeting of Shareholders, the Board determined its current intention to include an advisory vote, consistent with the 2017 frequency of say on pay advisory shareholder vote, on executive compensation every year in its proxy statement. This will provide annual feedback from shareholders on the Company's pay practices.

Employment Agreements: Consistent with shareholder advisory guidance, the Company's executive employment agreements provide for change of control "double trigger" severance benefits upon a termination of employment without cause or by the executive for good reason by applying the applicable multiple of two to three times to the sum of base pay plus target bonus for the relevant year instead of applying the multiple to the executive average annual taxable compensation for the five-year period prior to the change of control.

Conservative: Total executive compensation is conservative as compared to industry standards and the Company's peer group.

Balanced: The Company's annual bonus plan is a balanced program based on quantitative and qualitative assessment of both the Company’s and the individual executive’s performance. In past years when targeted financial performance was not fully achieved, individually or company-wide, based on either objective or subjective standards, or both, bonuses were materially reduced or not awarded at all, in some cases even if threshold levels of performance were in fact achieved.

Annual Review: The annual bonus is based on goals that are reviewed and updated yearly and are set to encourage long-term profitability within accepted conservative risk parameters.

Shareholder Aligned: Long-term equity-based incentives, such as stock option awards and restricted stock units ("RSUs"), recognize and encourage an alignment of executives' goals over the long term with those of the shareholders. Awards provide for vesting over a three- to four-year period, which may be incremental or cliff vesting. Stock option awards, even at the highest executive level, are generally modest, and there have been years in which they were not awarded.modest. Exercise prices are determined based on the closing price of the Company’s stock on the day of grant. Stock options only have value if the Company’s stock price increases.

No Backdating or Reloading: The 2013 LTIP under which Company stock options are granted does not permit “backdating” or “reloading” of option grants. Downward repricing of our outstanding stock options is not permitted without shareholder approval.

Ownership Requirements: NEOs are required to own specific amounts of our stock based on their annual salaries.

No Tax Gross-Up: The Company does not have tax gross-up plans for NEOs.

No Golden Parachutes: The Company does not have "golden parachutes" for NEOs; the top change-in-control payment is capped consistent with limits in the Internal Revenue Code so as to prevent the triggering of excess parachute taxes on the Company.

Voting Item 3 – Approval of the Amendment to the Company's Certificate of Incorporation to Increase the Number of Authorized Shares of Common2020 Directors' Stock Plan

Summary and Board Recommendation:

Item 3 is a proposal to approve an amendment tothe Arrow Financial Corporation 2020 Directors’ Stock Plan (the “2020 Directors’ Stock Plan”), which, if approved by our Certificate of Incorporation.shareholders, will authorize 50,000 shares for issuance thereunder and succeed and replace the 2013 Directors’ Stock Plan. The Board of Directors has unanimously approved, subject to shareholder approval, an amendment to Section 4.1 of our Certificate of Incorporation to increaseprincipal reason for the total number of authorized shares of common stock from 20,000,000 shares to 30,000,000 shares. Subject to shareholder approval, Section 4.1 of our Certificate of Incorporation will be amended and restated in its entirety as follows:

"4 Number of Shares; Preemptive Rights Denied:

4.1 The aggregate number of shares which the Corporation shall have authority to issue is Thirty-One Million (31,000,000) of which Thirty Million (30,000,000) shares shall be common shares of a par value of One Dollar ($1.00) each, and One Million (1,000,000) shares shall be preferred shares of a par value of One Dollar ($1.00) each. The relative rights, preferences and limitations of such shares are as follows:

4.1.1 Common Shares. Subject to the rightsrecommended adoption of the preferred shares, established as hereinafter set forth, and except as otherwise provided herein, the common shares shall have all such rights as are expressly provided to such shares herein and by the Business Corporation Law of the State of New York, and as are customarily attendant to such shares.

4.1.2 Preferred Shares. The Board of Directors of the Corporation2020 Directors’ Stock Plan is hereby expressly authorized to cause the preferred shares to be issued from time to time, in series, by resolution adopted prior to the issue of shares of a particular series, and to fix and determine, in such resolution, the designations, relative rights, preferences and limitations of the shares of each series, including voting, dividend and liquidation rights, and all other matters with respect to such shares as are permissible to be so fixed and determined under the provisions of the Business Corporation Law of the State of New York.”

Vote Recommendation: Your Board recommends you vote “For,” the amendment to the Certificate of Incorporation.

Amendment Details:

As of February 28, 2019, there were [-] shares of common stock outstanding and [-] outstanding options to purchase additional shares of our common stock. Meanwhile, [-] shares are reserved for issuance underthat the Arrow Financial Corporation 2013 Directors’ Stock Plan (the “2013 Directors’ Stock Plan”), previously approved by our shareholders, has only a small number of remaining available and unissued shares (approximately 10,000 shares as of December 31, 2019). Because the Arrow Financial Corporationremaining number of available shares is insufficient for the continued operation of the plan and the Board continues to believe that granting stock awards to Directors is in the best interests of the Company, the Board approved the 2020 Directors’ Stock Plan on January 29, 2020, as the successor plan to the 2013 Long Term IncentiveDirectors’ Stock Plan. If the 2020 Directors’ Stock Plan is not approved by the Arrow Financial Corporation 2011 EmployeeCompany’s shareholders at the Annual Meeting, the Company will be able to continue to issue shares under the 2013 Directors’ Stock PurchasePlan as currently in effect until the shares remaining for future grants are exhausted. The terms of the 2020 Directors’ Stock Plan are generally consistent with the terms of the 2013 Directors’ Stock Plan.

The description below addresses key elements of the proposed 2020 Directors’ Stock Plan. The complete text of the 2020 Directors’ Stock Plan is set forth in Annex A to this Proxy Statement. The following summary of the 2020 Directors’ Stock Plan does not purport to be complete and is subject in all respects to the provisions contained in the complete text.

The 2020 Directors’ Stock Plan, like the 2013 Directors’ Stock Plan, provides for the issuance to Directors of the Company and its subsidiary banks of shares of the Company’s common stock, in lieu of cash, as payment of some or all of the fees payable to them as Directors, including their annual retainer and meeting fees. Directors who are also officers (i.e., Management Directors) do not receive Directors’ fees. There are currently 11 non-Management Directors who receive Directors' fees. The specific portion and type of Directors’ fees payable in shares of stock is fixed, from time to time, by the Company’s Board in its sole discretion. Individual Directors have no right to opt out of the plan or to increase or decrease the portion of their fees payable in the form of shares from the levels fixed by the Board. Historically, the Board, in making its annual determination on fees payable in stock, has designated a portion of Directors’ basic annual retainers, as opposed to meeting fees, as payable in such form and has decided to pay such shares semi-annually, in May and November. The Board has also determined to pay a fixed dollar amount of all Directors’ annual retainers in shares of the Company’s common stock, even though different Directors receive differing dollar amounts as their total annual retainer, depending on whether or not they have additional duties. The benefits and amounts that will be received by individual non-Management Directors of the Company or its subsidiary banks under the 2020 Directors’ Stock Plan are not presently determinable. All grants are discretionary. For information on the amounts of Directors’ fees paid in 2019 in the form of stock under the 2013 Directors’ Stock Plan, see “Director Compensation” in the Voting Item 1 – Election of Directors section.

Shares distributed to Directors under the 2020 Directors’ Stock Plan, as under the predecessor 2013 Directors’ Stock Plan, will be valued at the market value of the shares on the date of distribution, determined as provided under such plan, and are fully vested and freely transferable by Directors upon their receipt thereof. The fair market value of distributed shares is taxable as ordinary income to the Directors upon their receipt and constitutes ordinary expense that is deductible by the Company for income tax purposes. The Board may change its determinations under the 2020 Directors’ Stock Plan at any time.

The table below sets forth our historic use of equity with respect to both employees and non-employee Directors in 2017, 2018 and 2019. All grants and weighted average basic common shares outstanding have been restated for stock dividends.

|

| | | | | | |

| Fiscal Year Ended December 31, | 2017 |

| 2018 |

| 2019 |

|

| Stock options granted | 59,009 |

| 55,070 |

| 53,560 |

|

| Time-based RSUs granted | — |

| 3,478 |

| 4,018 |

|

| Basic average shares outstanding | 14,739,000 |

| 14,840,000 |

| 14,940,000 |

|

As of the December 31, 2019, we had 241,242 stock options outstanding and 7,496 RSUs outstanding. Further, there are 225,485 shares remaining available for awards under our 2013 LTIP. In aggregate, these outstanding equity awards and remaining available shares, when combined with the 50,000 new shares under the 2020 Directors’ Stock Plan, if approved by our shareholders, result in a dilution level of approximately 3.50%.

A table setting forth certain information regarding Arrow's equity compensation plans as of December 31, 2019 can be found in Part II, Item 5 of our Annual Report on Form 10-K for the year ended December 31, 2019, under the caption “Equity Compensation Plan Information.”

The number of shares authorized for issuance under the 2020 Directors’ Stock Plan will be subject to adjustment to reflect future stock dividends or stock splits, corporate mergers or reorganizations, or similar changes in shares of the Company’s common stock generally. The Compensation Committee, which makes recommendations to the full Board regarding compensation of Directors, believes the adoption of the 2020 Directors’ Stock Plan and the Arrow Financial Corporation Automatic Dividend Reinvestment Plan (collectively, the “Arrow Equity Plans”).

After accounting for these items, only [-] unallocated sharescontinuation of its historical practice of issuing Company common stock remain available for future issuance. Theto its Directors as a part of Director compensation is in the best interests of the Company’s shareholders because it enhances share ownership by Directors and further aligns Directors’ financial interests with those of other Company shareholders.

Accordingly, the Compensation Committee recommended to the Board of Directors believes it isthat the 2020 Directors’ Stock Plan be approved by the Board to succeed and replace the 2013 Directors’ Stock Plan. On January 29, 2020, the Board determined that the 2020 Directors’ Stock Plan was in the best interests of the Company and its shareholders, approved it, and directed that it be submitted to increasethe Company’s shareholders for approval. The Board is vested with sole discretion to amend the 2020 Directors’ Stock Plan, but shareholder approval is required for any material amendments, including any increases in the number of shares authorized for issuance thereunder.

Approval of the Company’s authorized common stock. No changes are being requested to2020 Directors’ Stock Plan will require the Company’s authorized Preferred Stock. Asaffirmative vote of February 28, 2019, no shares of Preferred Stock were outstanding.

The additional authorized shares of common stock will provide the Company and our Board of Directors with the flexibility to issue common stock for a variety of purposes in the future. These purposes could include, among other things, to pay our common stock dividends, to provide equity compensation and incentives to employees and directors, to acquire other companies or purchase assets consistent with a disciplined acquisition strategy, to raise additional capital and for other bona fide corporate purposes. Other than shares reserved for issuance under the Arrow Equity Plans, and common stock dividends expected to be consistent with our past practices, we have no written or other plans, proposals, arrangements, agreements or understandings to issue any shares of common stock at this time.

The additional shares of common stock will be available for issuance without further action by our shareholders unless such action is required by applicable law or by the rules of any applicable stock exchange. Under our Certificate of Incorporation, the holders of our common stock do not have preemptive rights with respect to future issuancesa majority of common stock. Thus, should our Board of Directors elect to issue additional shares of common stock, our existing shareholders will not have any preferential rights to purchase such shares and such issuance could have a dilutive effect on the voting power and percentage ownership of these shareholders. The issuance of additional shares of common stock could also have a dilutive effect on our earnings per share.

Any additional authorized shares of common stock will be identical to the shares of common stock now authorized and outstanding. The proposed increasepresent in the number of shares of common stock will not change the number of shares of stock outstanding, have any immediate dilutive effectperson or change the rights of current holders of our common stock. However, the increase in the number of shares of common stock authorized for issuance could, under certain circumstances, be construed as having an anti-takeover effect. For example, in the event a person seeks to effect a change in the composition of our Board of Directors or contemplates a tender offer or other transaction involving the combination of the Company with another company, it may be possible for us to impede the attemptrepresented by issuing additional shares of common stock, thereby diluting the voting power of the other outstanding shares and increasing the potential cost to acquire control of the Company. By potentially discouraging initiation of any such unsolicited takeover attempt, our Certificate of Incorporation may limit the opportunity for our shareholders to dispose of their sharesproxy at the higher price generally available in takeover attempts or that may be available under a mergerAnnual Meeting and voting on this proposal. The increase in

Vote Recommendation: Your Board recommends you vote “For” the number of shares of common stock may also have the effect of permitting members of our current management, including our Board of Directors, to retain their positions indefinitely and place them in a better position to resist changes that shareholders may wish to make if they are dissatisfied with the conduct of our business. However, we have not proposed the increase in the number of authorized shares of common stock with the intention of using the additional authorized shares for anti-takeover purposes or the entrenchment of management.new 2020 Directors’ Stock Plan.

If approved by our shareholders, the proposed amendment to our Certificate of Incorporation would become effective upon filing with the Secretary of State of New York. We anticipate that this filing would be made as promptly as reasonably practicable following our Annual Meeting.

Voting Item 4 – Ratification of the Selection of KPMG LLP as Our Independent Auditor for 20192020

Summary and Board Recommendation:

The Audit Committee of the Board has selected the independent registered public accounting firm, KPMG LLP ("KPMG"), as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019.2020. The selection process included a thorough review of KPMG’s performance in prior years, the quality and expertise of the KPMG management team, its understanding and expertise in the industries in which the Company operates, the appropriateness of the fees charged, and its familiarity with the Company’s internal controls and accounting policies and practices.

Although Company Bylaws do not require the selection of the independent registered public accounting firm be submitted to shareholders for approval, the Board believes it is appropriate to give shareholders the opportunity to ratify the decision of the Audit Committee. Neither the Audit Committee nor the Board will be bound by the shareholders’ vote, but they may take it into account in future determinations regarding the retention of the Company’s independent registered public accounting firm.

registered public accounting firm.

Representatives of KPMG are expected to be present at the Annual Meeting. They will have an opportunity to make a statement, if they so desire, and are expected to be available to respond to appropriate questions from shareholders.

Ratification of the selection of KPMG will require the affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting and voting on this proposal.

Vote Recommendation: Your Board recommends you vote “For” the ratification of the independent registered public accounting firm, KPMG LLP, as the independent auditor of the Company for the fiscal year ending December 31, 20192020.

Independent Registered Public Accounting Firm Fees:

The following table sets forth the aggregate fees billed to the Company and its subsidiaries for the fiscal years ended December 31, 20182019 and 2017,2018, by the Company’s independent registered public accounting firm, KPMG. The tax fees in this table represent fees paid to KPMG for the specified year for tax preparation and consulting services.

|

| | |

Categories of Service | 2018 (a)

| 2017 |

Audit Fees | — | $437,000 |

Audit-Related Fees | — | — |

Tax Fees | — | $85,600 |

All Other Fees | — | — |

Total Fees | — | $522,600 |

|

| | | | | | |

| Categories of Service | 2019 | 2018 |

| Audit Fees | $ | 585,620 |

| $ | 446,500 |

|

| Audit-Related Fees | — | — |

|

| Tax Fees | 81,600 |

| 95,040 |

|

| All Other Fees | — | — |

|

| Total Fees | 667,220 |

| 541,540 |

|

(a) Data to be completed at the time of filing the definitive statement.

Audit Committee Report

Each member of the Audit Committee qualifies as independent under both the NASDAQ® standards for independent directors and the more rigorous Securities and Exchange Commission (“SEC”) standards for independent Audit Committee members. For more detail, see the Corporate Governance section. The Audit Committee assists the Board in fulfilling its oversight role relating to the Company’s financial statements and the financial reporting process, including the system of disclosure controls and the Company’s internal controls and procedures. Its duties include reviewing the independent registered public accounting firm’s qualifications and independence, the performance of the independent registered public accounting firm, and the Company’s internal audit function. The duties of the Audit Committee are set forth in the Audit Committee Charter, which has been adopted by the Board and is reviewed annually by the Committee. A copy of the current charter of the Audit Committee is available on our website at www.arrowfinancial.com/corporate/governance.

Management has the responsibility for preparing the Company’s consolidated financial statements and for assessing the effectiveness of its internal controls over financial reporting. The Company’s independent registered public accounting firm, KPMG, has the responsibility for auditing these consolidated financial statements. KPMG reports directly to the Audit Committee, and they meet on a regular basis. The Audit Committee has reviewed and discussed with Management and KPMG the Company’s audited consolidated financial statements as of and for the year ended December 31, 2018.2019. The Audit Committee has also discussed with Management its assertion on the design and effectiveness of the Company’s internal control over financial reporting as of December 31, 2018,2019, and has discussed with KPMG the matters required to be discussed by professional standards. Based on this review and discussion, the Audit Committee recommended to the Board that the audited consolidated financial statements of the Company and its subsidiaries, and Management’s assertion on the design and effectiveness of internal control over financial reporting of the Company and its subsidiaries, be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018,2019, as filed with the SEC.

The Audit Committee has approved the engagement of KPMG as the Company’s independent registered public accounting firm for 20192020 and the scope of its work. The Audit Committee has also discussed with KPMG the firm’s assessment of the Company’s internal controls and the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standards No. 1301, “Communications with Audit Committees.” The Audit Committee has received and discussed the written disclosures and the letter from KPMG required by Public Company Accounting Oversight Board Rule 3526, “Communication with Audit Committees Concerning Independence.” The Audit Committee has discussed with KPMG the firm’s independence and determined that the non-audit services provided to the Company by KPMG are compatible with its independence.

Michael B. Clarke, Chair

David G. Kruczlnicki Colin L. Read

Elizabeth A. Miller Richard J. Reisman

Corporate Governance

The Board’s Corporate Governance Guidelines provide the framework within which the Company’s Directors and Executive Officers manage the business and affairs of the Company. The Company is managed under the direction and oversight of the Board. The Board appoints the CEO, who is responsible for the day-to-day operation of the Company. The Board’s primary responsibilities, thereafter, are to oversee management and to exercise its business judgment to act in what it reasonably believes to be the best interests of the Company and its shareholders.

At least once each year, the Board will review the Company’s long-term strategic plans and future key issues. The Board may elect a Lead Director from the independent Directors of the Company to serve as a liaison between the Board Chair and the independent or non-Management Directors and to have such other duties and responsibilities as shall be determined by the Board, including chairing the Executive Sessions of the independent Directors.

The Governance Committee of the Board is responsible for reviewing with the full Board, on an annual basis, the requisite skills and characteristics of all Board members, as well as nominees for Director and the composition of the Board as a whole. This assessment will include whether individual Directors or nominees qualify as independent under applicable law and guidelines, as well as consideration of diversity, age, skills and experience of the Directors as a group in the context of the needs of the Board. A majority of Directors must meet the criteria for general Board independence as required and defined by NASDAQ®. Directors generally must satisfy certain other applicable laws, rules and regulations.

The Board’s membership is divided into three classes, equal in number. One class is elected each year by the Company’s shareholders to a term of three years. The Governance Committee identifies and recommends to the full Board suitable candidates for nomination for Director, including, when appropriate, incumbent Directors. In making its recommendations, the Governance Committee will consider any proposals it properly receives from shareholders for Director nominees. Shareholders may propose a Director candidate for consideration by the Governance Committee by following the rules described below under the heading “Shareholder Submissions of Director Nominees for the 20202021 Annual Meeting” in the Additional Shareholder Information section. The Governance Committee’s recommendations of candidates for nomination will be based on its determination as to the suitability of the particular individuals, and the slate as a whole, to serve as Directors of the Company, taking into account the criteria discussed above. When evaluating incumbent Directors who are nominated for reelection, the Governance Committee considers, in addition to past performance, each such Director’s attendance record for meetings of the Company’s Board, its subsidiary banks’ boards and committees on which the Director serves, as applicable. See “Director Nomination Process” in the Voting Item 1 – Election of Directors section for a discussion of additional criteria considered in the selection of Directors for nomination.

The Board does not believe that Directors should be subject to term limits. While term limits may in some cases enhance the flow of fresh ideas and viewpoints in the boardroom, they may also result in the loss of knowledgeable and experienced Directors, whose insights into the Company and its operations typically expand and deepen over time. When evaluating whether incumbent Directors should be renominated, the Governance Committee will consider, in addition to the incumbent’s prior performance on the Board, the same general qualities and attributes, such as suitability, character, general experience and background that it applies to new candidates for Director. Additionally, the

Company’s Bylaws provide that Directors will retire from the Board at the first Annual Meeting of Shareholders held on or after they attain the age of 75.

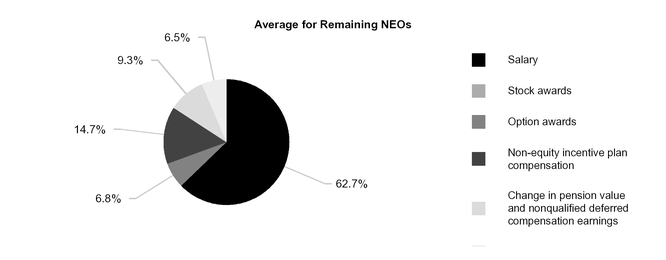

Board Leadership Structure: